Divorce is already difficult, but the process becomes even more complicated when one spouse attempts to hide money in cryptocurrency.

Digital assets like Bitcoin, Ethereum, and other forms of crypto are becoming more common in divorce cases. Their anonymous, decentralized nature makes them easier to conceal, especially from a spouse who isn’t involved in the household finances.

If you suspect hidden crypto in your divorce, here’s what you need to know and how to protect your financial future.

Why Cryptocurrency Is Hard to Trace

Unlike traditional bank accounts, cryptocurrency isn’t tied to a central financial institution. It can be transferred across the blockchain with little oversight and stored in:

- Online platforms like Coinbase or Binance

- USB drives or hardware wallets

- Private apps or encrypted digital wallets

Because these assets often don’t appear in standard account statements, they can go undetected without a thorough investigation.

For a legal consultation, call 203-288-7800

Red Flags That May Point to Hidden Crypto

While not always obvious, signs of concealed cryptocurrency may include:

- Sudden interest in crypto trading or investment platforms

- Missing funds from joint accounts

- Secretive behavior around technology or finances

- Crypto-related mobile apps or browser history

- Discrepancies in income or reported assets

Even if you don’t have proof, these signs are worth discussing with your legal team.

Is Crypto Considered Marital Property in Connecticut?

Yes. If the cryptocurrency was acquired during the marriage, it’s generally considered marital property and subject to division under Connecticut’s equitable distribution laws.

Your spouse is legally required to disclose all assets, including crypto, during financial discovery. Failing to do so may be considered fraud, which can have serious legal and financial consequences.

Click to contact our family law lawyers today

How to Uncover Hidden Cryptocurrency

If you believe your spouse is concealing digital assets, your attorney may work with a forensic accountant to:

- Review tax returns and financial disclosures

- Subpoena crypto exchange accounts (such as Kraken or Gemini)

- Analyze blockchain activity for hidden wallet addresses

- Trace unusual transfers or conversions from bank accounts

Even anonymous wallet transactions can leave behind a trail if you know where to look.

Complete a Legal Consultation form now

What If the Crypto Is Discovered After Divorce?

If you learn that your spouse hid assets after your divorce is finalized, you may have legal grounds to reopen the case. Courts take asset concealment seriously, and may:

- Redistribute assets in your favor

- Order repayment or compensation

- Impose legal penalties on your former spouse

Taking proactive steps during the divorce process can help avoid these challenges.

When to Work with a New Haven Divorce Lawyer

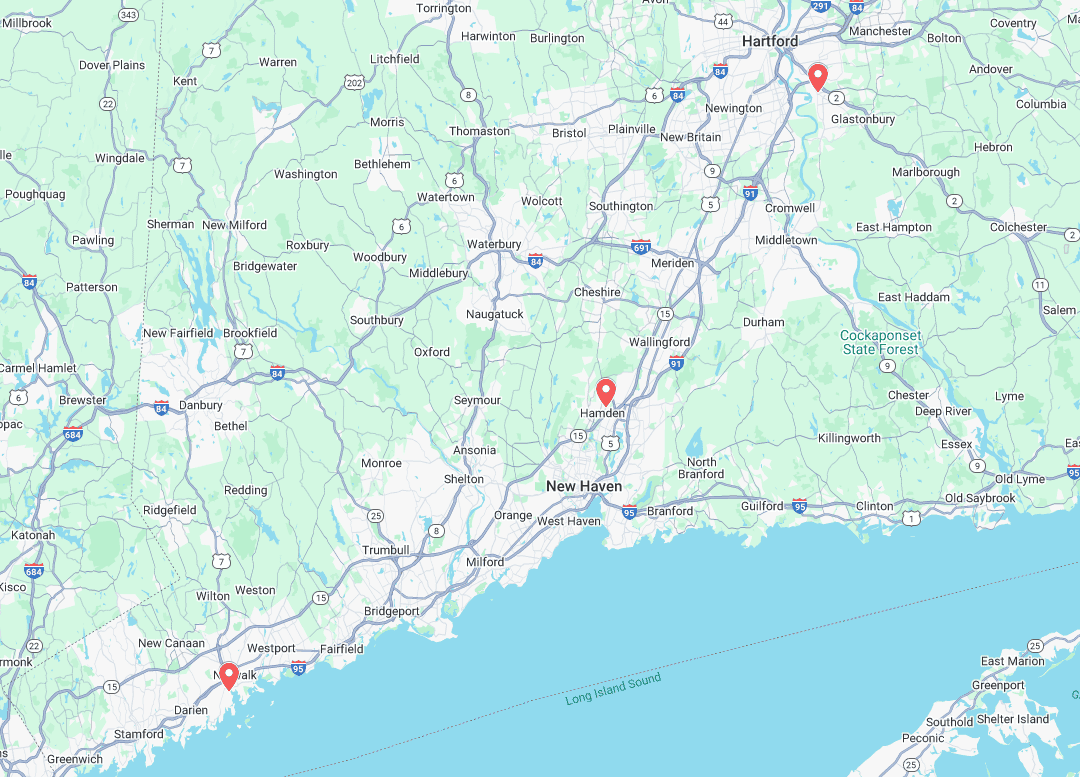

Cryptocurrency complicates divorce, but you don’t have to handle it alone. A New Haven divorce lawyer with experience in digital asset division can help you uncover hidden crypto, enforce proper financial disclosures, and secure your share of marital property.

Legal guidance is essential when modern assets meet complex divorce law.

Protecting Yourself from Asset Concealment

To protect your interests:

- Gather all account statements and tax returns

- Note changes in spending or saving habits

- Pay attention to unexplained bank transfers

- Ask direct questions about digital investments

- Work with a legal team that understands crypto and finance

While you may not know exactly what your spouse is doing, your lawyer can help uncover what’s being hidden.

Digital Wealth Is Real Wealth – Don’t Let It Disappear

Cryptocurrency may be intangible, but it can carry real financial weight in a divorce settlement. If your spouse is hiding assets, especially digital ones, it’s critical to take action early.

At Happy Even After, we help clients navigate the complexities of modern divorce, including cases involving hidden cryptocurrency. Whether you’re dealing with traditional assets or digital wallets, we’ll help you secure a fair outcome and protect your future.

Call or text 203-288-7800 or complete a Legal Consultation form